Imprivata, Inc. Reports Third Quarter 2014 Financial Results

Imprivata achieves record revenues of $25.3 million, a 41% increase over the comparable period of 2013, and increases annual revenue guidance.

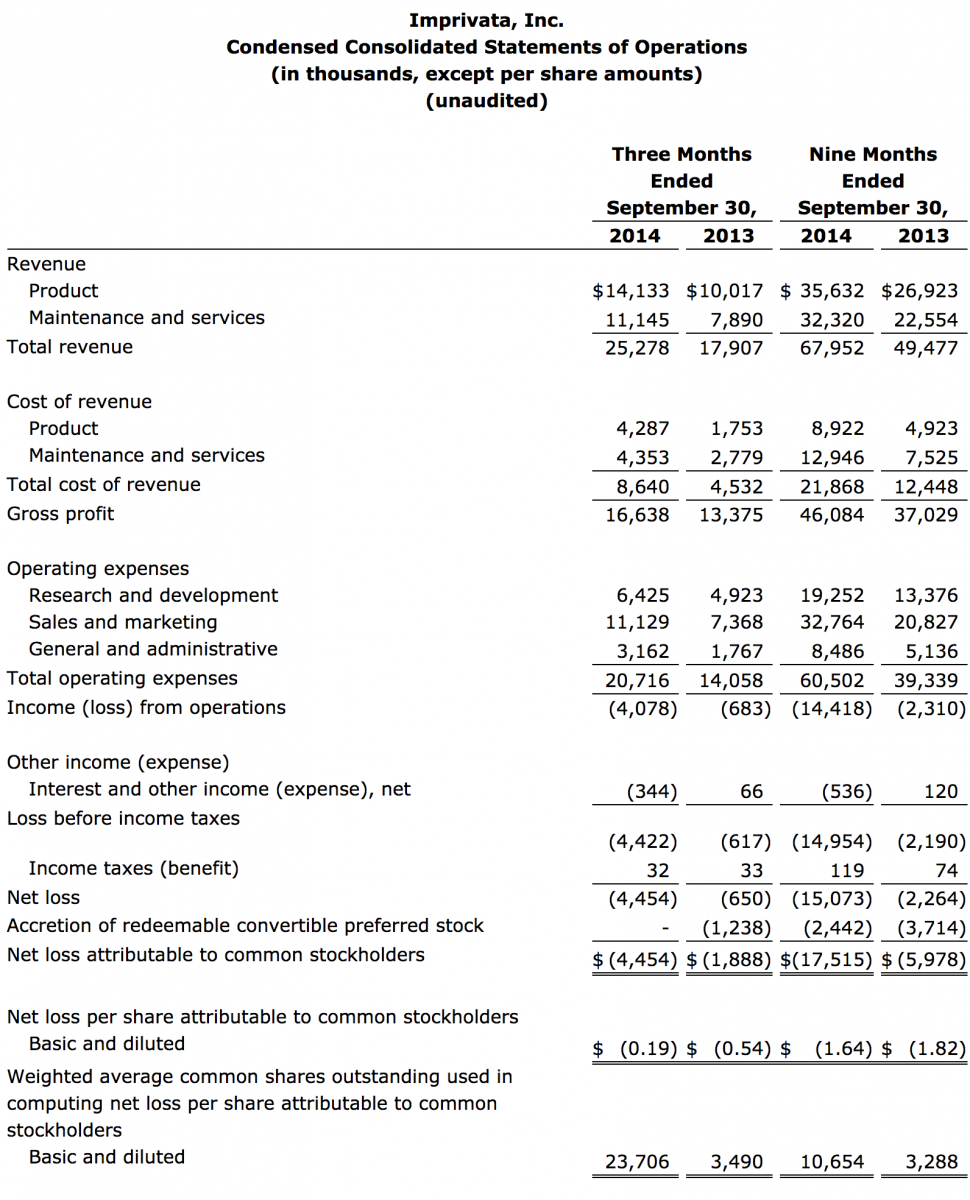

Lexington, Mass. - November 3, 2014 - Imprivata® (NYSE: IMPR), a leading provider of authentication and access management solutions for the healthcare industry, today announced financial results for the third quarter of fiscal 2014. Revenues for the third quarter were $25.3 million, an increase of 41% from revenues of $17.9 million for the same period in 2013. Revenues for the nine months ended September 30, 2014 were $68.0 million, an increase of 37% from revenues of $49.5 million for the same period in 2013.

Omar Hussain, CEO of Imprivata, commented, “Our record third quarter revenues were driven by both new and existing customers, along with key competitive takeaways. We continue to see strong demand in our business driven by Meaningful Use Stage 2 initiatives, hospitals deploying Virtual Desktop Infrastructures, and the increasing adoption of EMRs globally. Our growth and success continue to validate that Imprivata solutions are important to our customers as they balance IT security with provider productivity.”

Net loss for the third quarter of 2014 was $4.5 million, or $(0.19) per basic and diluted share attributable to common stockholders, as compared to a net loss of $0.7 million, or $(0.54) per basic and diluted share attributable to common stockholders for the same period in 2013. Net loss for the nine months ended September 30, 2014 was $15.1 million, or $(1.64) per basic and diluted share attributable to common stockholders, as compared to a net loss of $2.3 million, or $(1.82) per basic and diluted share attributable to common stockholders for the same period in 2013. Consistent with our operating results for the first half of 2014, the quarterly loss represents our continued strategic investments in the business to maintain our market leadership position and capture additional market share, as well as develop new complementary products to our existing product portfolio.

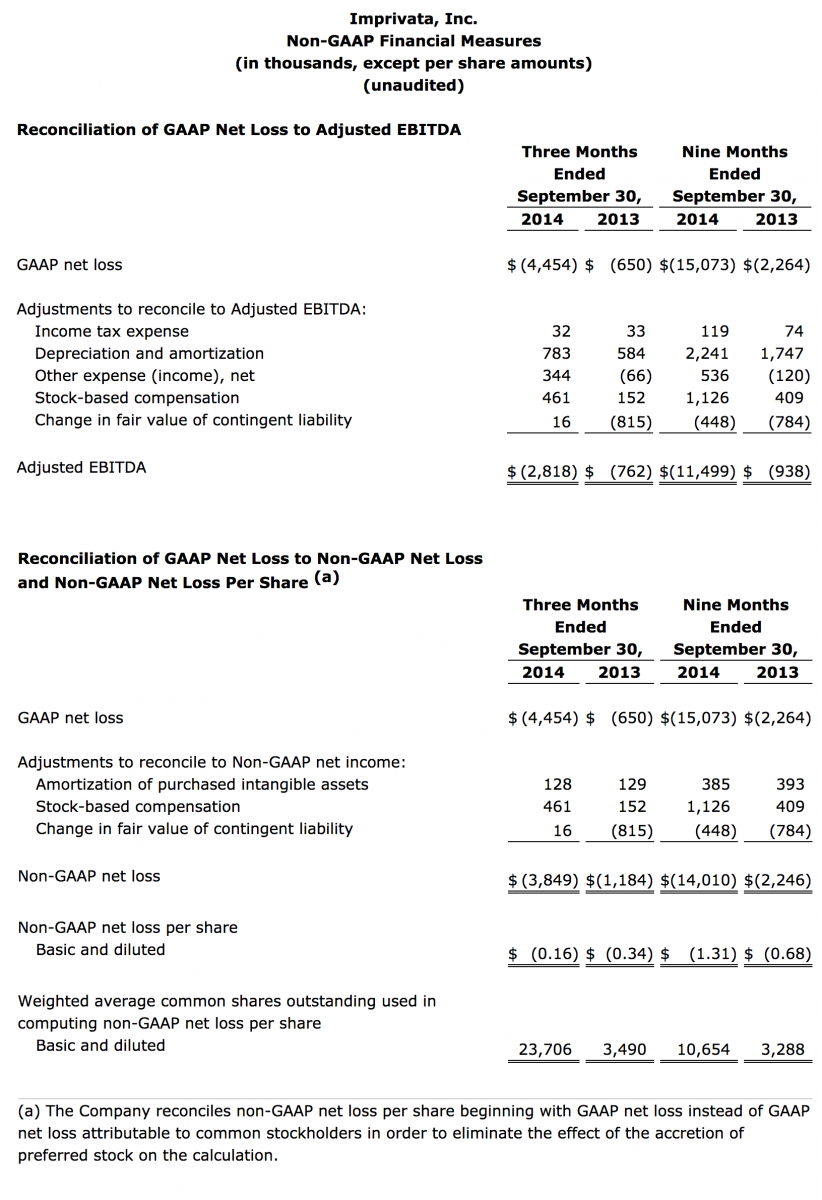

Adjusted EBITDA(1) for the third quarter of 2014 was a loss of $2.8 million, as compared to a loss of $0.8 million for the same period in 2013. Non-GAAP net loss (2) for the third quarter of 2014 was $3.8 million, or $(0.16) per basic and diluted share, as compared to non-GAAP net loss of $1.2 million, or $(0.34) per basic share and diluted share, for the same period in 2013. Adjusted EBITDA for the nine months ended September 30, 2014 was a loss of $11.5 million, as compared to a loss of $0.9 million for the same period in 2013. Non-GAAP net loss for the nine months ended September 30, 2014 was $14.0 million, or $(1.31) per basic and diluted share, as compared to non-GAAP net loss of $2.2 million, or $(0.68) per basic and diluted share, for the same period in 2013. A reconciliation of GAAP to these non-GAAP financial measures has been provided in the financial statement tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

(1) Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization adjusted for foreign currency gains (losses), stock based-compensation and the impact of the fair value revaluation on our contingent liability.

(2) Non-GAAP net income (loss) and non-GAAP net income (loss) per share excludes amortization of purchased intangible assets, stock-based compensation and the impact of the fair value revaluation on our contingent liability.

Fourth Quarter and Full-Year 2014 Financial Outlook

For the full-year, we expect revenue between $94 million and $95 million and Adjusted EBITDA to be between a loss of $14 million and $13 million. In terms of earnings per share, we expect GAAP loss to be between $1.51 per share and $1.47 per share and non-GAAP loss, which adjusts for stock-based compensation, amortization of purchased intangible assets and the contingent liability revaluation, to be between $1.19 per share and $1.16 per share. Our annual EPS estimates are based on an estimated weighted average-share count of 13.9 million.

For the fourth quarter, we expect revenue between $26 million and $27 million and Adjusted EBITDA to be between a loss of $2.0 million and $1.0 million. In terms of earnings per share, we expect GAAP loss to be between $0.15 per share and $0.13 per share and non-GAAP loss to be between $0.11 per share and $0.09 per share. Our fourth quarter EPS estimates are based on an estimated weighted average-share count of 23.7 million.

Conference Call Information

Imprivata management will host a conference call at 5:00 pm (Eastern Time) on Monday, November 3, 2014 to discuss the Company’s third quarter 2014 results, its business outlook and other matters. The conference call will be accessible by dialing (888) 364-3108, or (719) 325-2464 for international callers, and referencing conference ID number 7055889. A live webcast of the conference call will also be available on the investor relations section of the company’s website at www.imprivata.com.

An audio replay will be available following the conclusion of the call through November 17, 2014. The replay can be accessed by dialing (888) 203-1112 in the U.S., or +1 (719) 457-0820 for international callers. The passcode for the replay is: 7055889.

About Imprivata

Imprivata, Inc. (NYSE: IMPR) headquartered in Lexington, Massachusetts, is a leading provider of authentication and access management solutions for the healthcare industry. Imprivata’s flagship solution, Imprivata OneSign®, is an integrated enterprise single sign-on, authentication and access management and workflow automation platform that addresses multiple security and productivity challenges faced by hospitals and other healthcare organizations. For more information, please visit www.imprivata.com.

Investor relations:

Bob East / Asher Dewhurst

Westwicke Partners, LLC

(443) 213-0503

imprivata@westwicke.com

Media relations:

Dan Borgasano

Imprivata, Inc.

(781) 430-2812

dborgasano@IMPRIVATA.com

All Imprivata products are trademarks of Imprivata, Inc. in the USA and other countries. All other product or company names mentioned are the property of their respective owners.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the anticipated opportunity and trends for growth in our customer base and our overall business, our market opportunity, our goal to maintain market leadership and our expected financial results for Q4 2014 and the full fiscal year 2014. All statements other than statements of historical fact contained in this press release are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “could,” “increases,” “improves,” “reduces,” “implements,” “results,” “addresses,” or the negative of these terms or other comparable terminology. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Imprivata’s control. Imprivata’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, our ability to successfully develop and introduce new solutions and products for existing solutions; our ability to attract new customers and retain and increase sales to existing customers; developments in the healthcare industry or regulatory environment; seasonal variations in the purchasing patterns of our customers; the lengthy and unpredictable sales cycles for new customers; our ability to maintain successful relationships with our channel partners and technology alliance partners; our dependency on sole source suppliers and a contract manufacturer for hardware components of our Imprivata OneSign solution; our ability to manage our growth effectively; our ability to respond to competitive pressures; potential liability related to privacy and security of protected health information; our ability to protect our intellectual property rights, and the other risks detailed in Imprivata’s risk factors discussed in filings with the U.S. Securities and Exchange Commission (“SEC”), including but not limited to Imprivata’s Registration Statement on Form S-1 declared effective by the SEC on June 24, 2014, as well as other documents that may be filed by Imprivata from time to time with the SEC. The forward-looking statements included in this press release represent Imprivata’s views as of the date of this press release. Imprivata undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

Imprivata has provided in this release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States, or GAAP. This information includes Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP net income (loss) per share. These non-GAAP financial measures are not in accordance with, or an alternative for, GAAP and may be different from similar non-GAAP financial measures used by other companies. Imprivata believes that the use of these non-GAAP financial measures provides supplementary information for investors to use in evaluating operating performance and in comparing its financial measures with other companies in Imprivata's industry, many of which present similar non-GAAP financial measures. Adjusted EBITDA (EBITDA adjusted for foreign currency gains (losses), stock based-compensation and the impact of the fair value revaluation on our contingent liability), non-GAAP net income (loss) and non-GAAP net income (loss) per share exclude amortization expense associated with our purchased intangible assets, stock-based compensation and the impact of the re-measurement to fair value of our contingent liability. Non-GAAP financial measures that Imprivata uses may differ from measures that other companies may use. These non-GAAP financial measures disclosed by Imprivata are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP, and should be viewed in conjunction with, GAAP financial measures. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measure. A reconciliation of GAAP to the non-GAAP financial measures has been provided in the tables included as part of this press release.