Access management solutions for frictionless and secure workflows

Our platform of innovative, interoperable access management and privileged access security solutions enable organizations to fully manage and secure all enterprise and third-party identities to facilitate seamless user access, protect against internal and external security threats, and reduce total cost of ownership.

Every workflow. Every user. Any device.

Fast, secure access can mean the difference between effective patient care and timely production of goods and services. When every second counts, you can count on Imprivata.

Make security invisible by embedding authentication directly into every workflow for seamless, consistent user interactions

High-demand users don’t have time to log in and out. Deliver simple, secure access for all user categories

Extend identity across shared device ecosystems, including workstations, mobile devices, operational technology, and healthcare connected devices

A simple promise, backed by decades of experience

We’ve been customer champions for over 20 years, working alongside the world’s most prominent healthcare and enterprise organizations to deliver access management solutions that improve user productivity, reduce cyber risks, and ensure compliance.

Leadership that fearlessly leads us forward

Our leaders are seasoned access management innovators, united by an unwavering commitment to customer success.

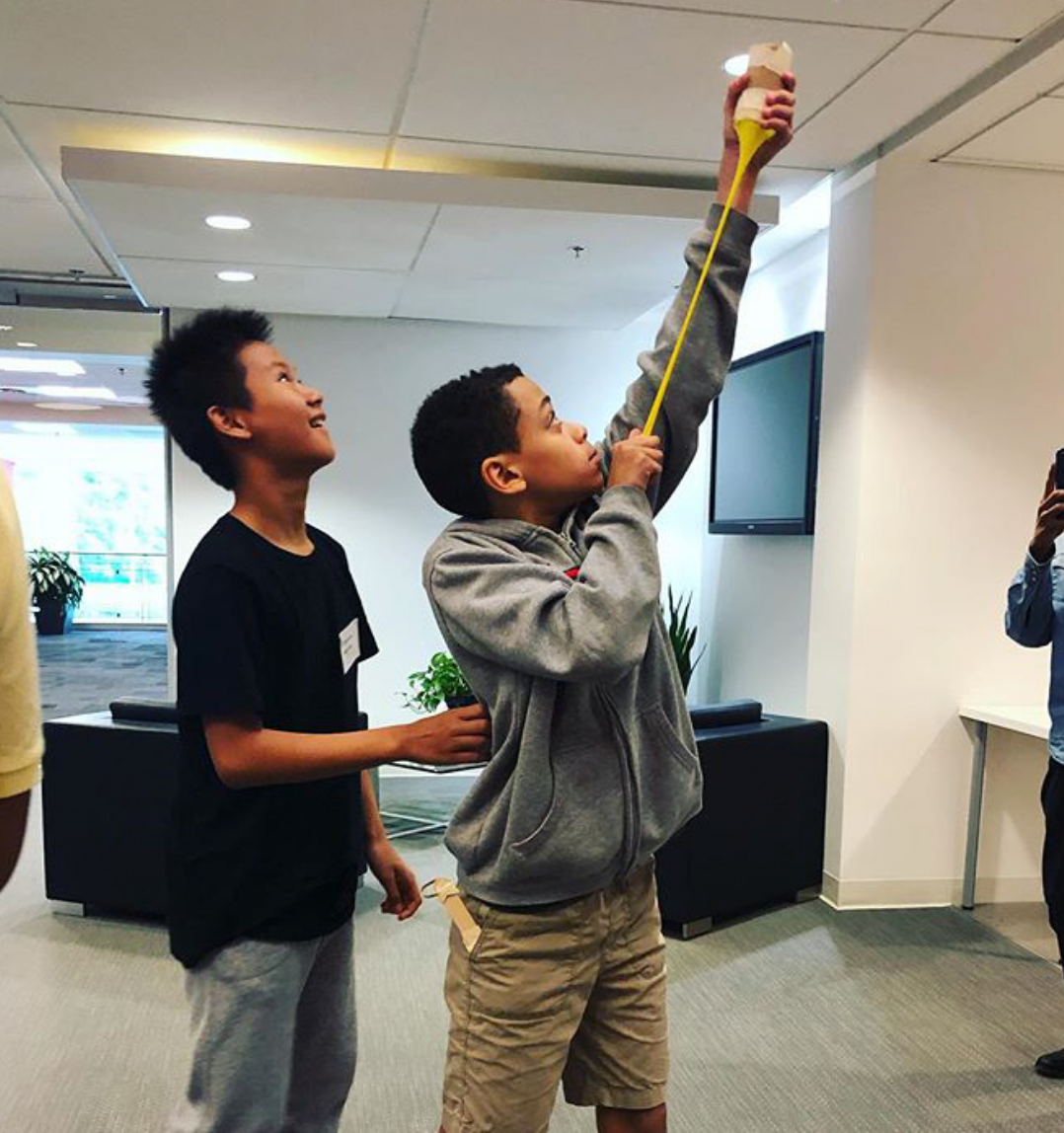

We’re more than a digital identity company. We’re a community.

Work isn’t just about earning a paycheck. We’re a global community unified by our commitment to customers, company values, and a philanthropic outlook.

-

45

countries where you’ll find Imprivata solutions

-

8

offices worldwide

-

100+

awards and recognition

Corporate responsibility

Recognition

From our solutions and people to our culture and vision, we’re consistently recognized for our excellence.