Imprivata Achieves Revenue Growth of 32% for the First Quarter of 2015 and Raises Annual Guidance

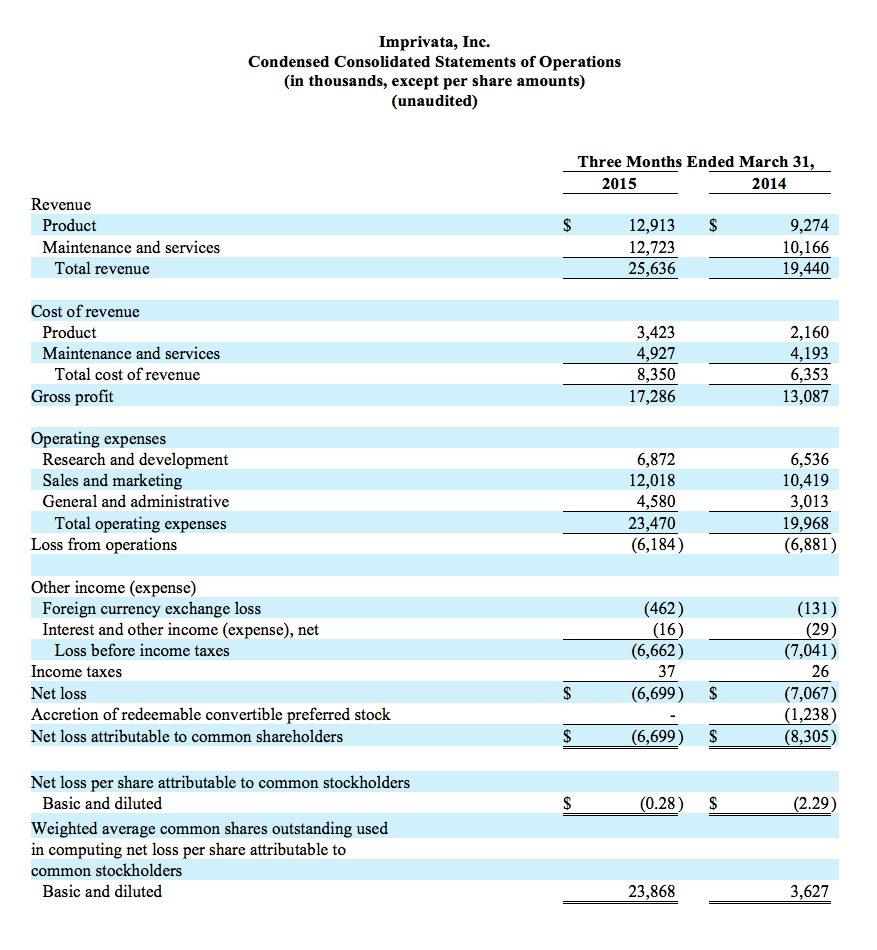

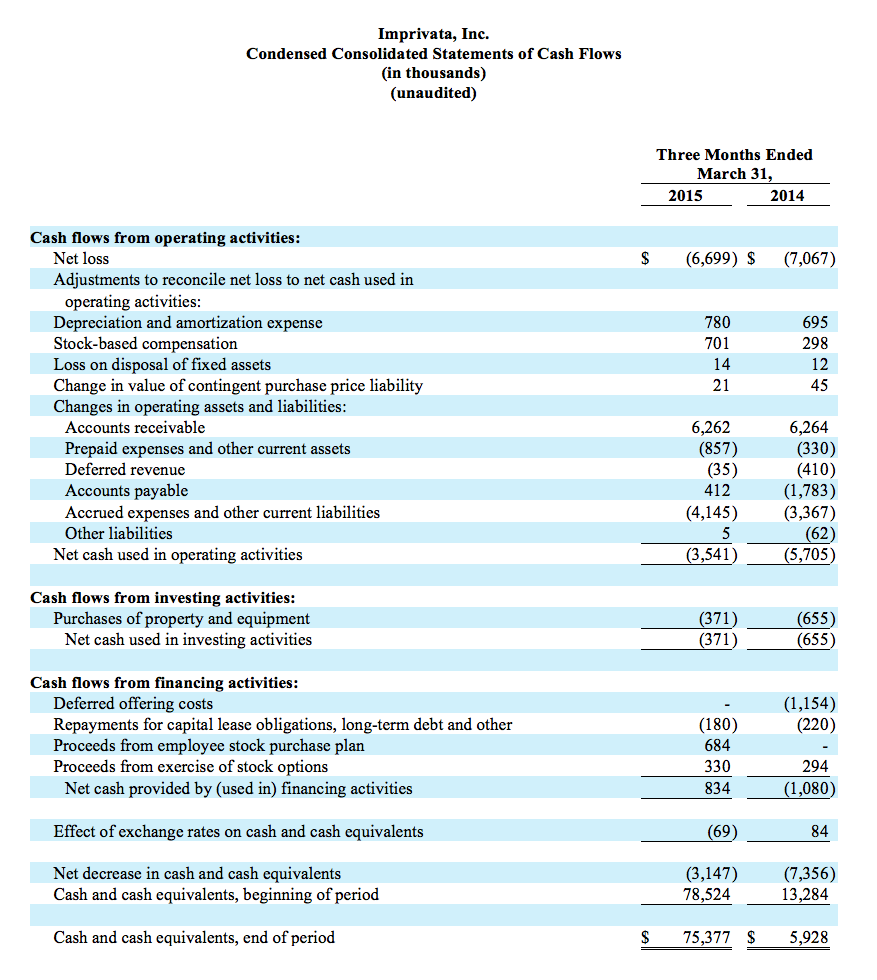

Lexington, Mass. — (BUSINESS WIRE) — May 4, 2015 — Imprivata® (NYSE: IMPR), the healthcare IT security company, today announced financial results for the first quarter of fiscal 2015. Revenues for the first quarter of 2015 were $25.6 million, an increase of 32% from revenues of $19.4 million for the same period in 2014.

“The strong business momentum we saw in 2014 continued in the first quarter and demand for our products remains strong across all geographies,” said Omar Hussain, President and CEO of Imprivata. “The macro driver for our business continues to be the need to improve clinician productivity and streamline workflows as providers are frustrated with using technology in the delivery of care. In addition, hospitals are increasingly focused on security and compliance with government regulations.”

Mr. Hussain continued, “Our acquisition of HT Systems reinforces our long term vision to be the healthcare IT security company. Our vision has always been around delivering innovative security products that increase provider productivity, enable patient engagement, and improve patient satisfaction. HT Systems currently has more than 60 customers and we share over 25 joint customers and also have relationships with Epic, Cerner and McKesson. We are excited about introducing this product to new customers as well as our existing 1,200 global healthcare customers through Imprivata’s existing distribution channels.”

Recent Product Highlights

- Launched Imprivata Confirm ID our solution for Electronic Prescribing of Controlled Substances (“EPCS”);

- Introduced Imprivata’s new patented hands-free authentication solution at the annual HIMSS Conference; and

- Imprivata had a significant presence as its products were also showcased by 24 of our strategic partners.

Financial Results

Net loss for the first quarter of 2015 was $6.7 million, or $(0.28) per basic and diluted share attributable to common stockholders, as compared to a net loss of $8.3 million, or $(2.29) per basic and diluted share attributable to common stockholders for the same period in 2014. Our quarterly loss represents continued strategic investments in the business.

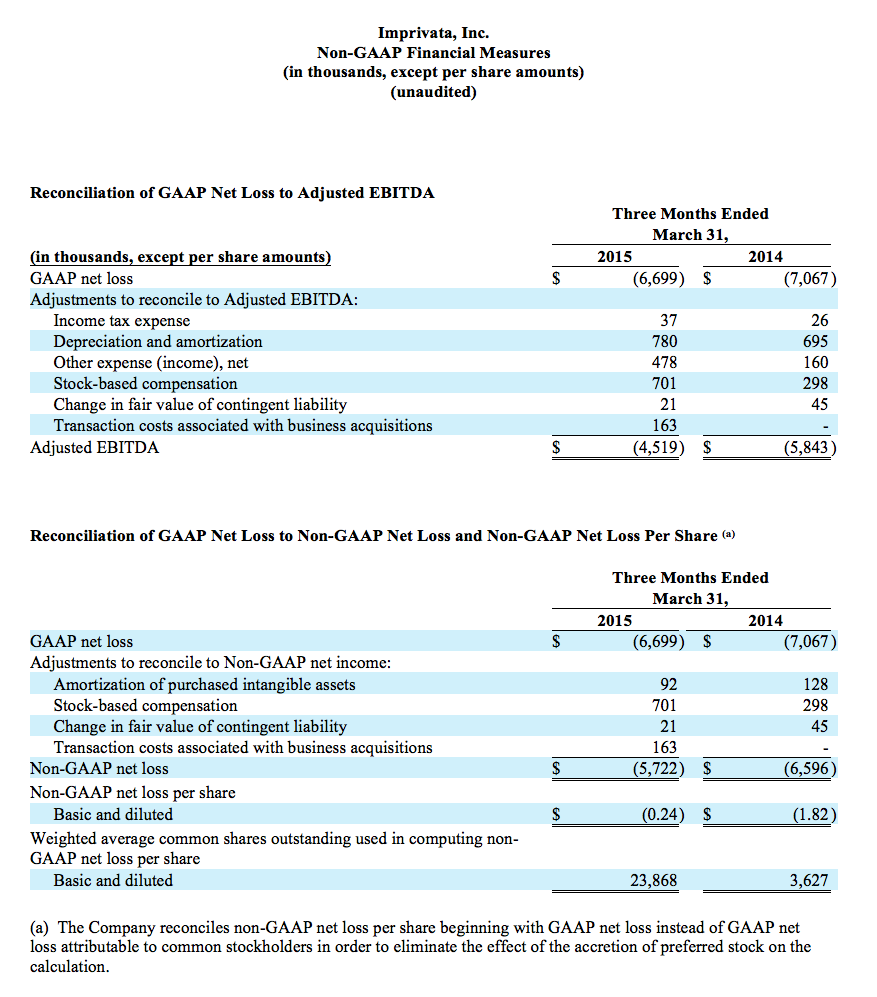

Adjusted EBITDA(1) for the first quarter of 2015 was a loss of $4.5 million, as compared to a loss of $5.8 million for the same period in 2014. Non-GAAP net loss (2) for the first quarter of 2015 was $5.7 million, or $(0.24) per basic and diluted share, as compared to non-GAAP net loss of $6.6 million, or $(1.82) per basic share and diluted share, for the same period in 2014. A reconciliation of GAAP to these non-GAAP financial measures has been provided in the financial statement tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

(1) Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization adjusted for foreign currency gains (losses), stock based-compensation and the impact of the fair value revaluation on our contingent liability.

(2) Non-GAAP net income (loss) and non-GAAP net income (loss) per share excludes amortization of purchased intangible assets, stock-based compensation and the impact of the fair value revaluation on our contingent liability.

For the full-year, we expect revenue between $123.5 million and $126.0 million and Adjusted EBITDA to be between a loss of $10.0 million and $8.5 million. In terms of earnings per share, we expect GAAP loss to be between $0.78 per share and $0.72 per share and non-GAAP loss, which adjusts for stock-based compensation, amortization of purchased intangible assets, transaction costs associated with business acquisitions and the contingent liability revaluation, to be between $0.59 per share and $0.52 per share. Our annual EPS estimates are based on an estimated weighted average-share count of 24.1 million.

Second Quarter and Full-Year 2015 Financial Outlook

For the second quarter, we expect revenue between $28.5 million and $29.5 million and Adjusted EBITDA to be between a loss of $4.4 million and $3.9 million. In terms of earnings per share, we expect GAAP loss to be between $0.29 per share and $0.27 per share and non-GAAP loss, which adjusts for stock-based compensation, amortization of purchased intangible assets, transaction costs associated with business acquisitions and the contingent liability revaluation, to be between $0.22 per share and $0.20 per share. Our annual EPS estimates are based on an estimated weighted average-share count of 24.1 million.

Conference Call Information

Imprivata management will host a conference call at 5:00 pm (Eastern Time) on Monday, May 4, 2015 to discuss the Company’s quarter ended March 31, 2015 results, its business outlook and other matters. The conference call will be accessible by dialing 888-359-3627 or 719-325-2432 for international callers, and referencing conference ID number 8355662. A live webcast of the conference call will also be available on the investor relations section of the company’s website at http://investor.imprivata.com/.

An audio replay of the conference call will be available approximately one hour after conclusion of the call and will be accessible through May 18, 2015. The replay can be accessed by dialing 888-203-1112, or 719-457-0820 for international callers, and providing access code 8355662.

About Imprivata

Imprivata, Inc. (NYSE: IMPR) headquartered in Lexington, Massachusetts, a leading provider of authentication and access management solutions for the healthcare industry. Imprivata’s single sign-on, authentication management and secure communications solutions enable fast, secure and more efficient access to healthcare information technology systems to address multiple security challenges and improve provider productivity for better focus on patient care. For more information, please visit www.imprivata.com.

Investors Contact

Westwicke Partners

Bob East / Asher Dewhurst

443-213-0503

imprivata@westwicke.com

Media Contact:

Imprivata

John Hallock

Vice President, Corporate Communications

781-761-1921

jhallock@IMPRIVATA.com

All Imprivata products are trademarks of Imprivata, Inc. in the USA and other countries. All other product or company names mentioned are the property of their respective owners.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the anticipated opportunity and trends for growth in our customer base and our overall business, our market opportunity, our goal to maintain market leadership and our expected financial results for Q1 2015 and the full fiscal year 2015. All statements other than statements of historical fact contained in this press release are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “could,” “increases,” “improves,” “reduces,” “implements,” “results,” “addresses,” or the negative of these terms or other comparable terminology. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Imprivata’s control. Imprivata’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, our ability to successfully develop and introduce new solutions and products for existing solutions; our ability to attract new customers and retain and increase sales to existing customers; developments in the healthcare industry or regulatory environment; seasonal variations in the purchasing patterns of our customers; the lengthy and unpredictable sales cycles for new customers; our ability to maintain successful relationships with our channel partners and technology alliance partners; our dependency on sole source suppliers and a contract manufacturer for hardware components of our Imprivata OneSign solution; our ability to manage our growth effectively; our ability to respond to competitive pressures; potential liability related to privacy and security of protected health information; our ability to protect our intellectual property rights, and the other risks detailed in Imprivata’s risk factors discussed in filings with the U.S. Securities and Exchange Commission (“SEC”), including but not limited to Annual Report on Form 10-K filed with the SEC on March 11, 2015, as well as other documents that may be filed by Imprivata from time to time with the SEC. The forward-looking statements included in this press release represent Imprivata’s views as of the date of this press release. Imprivata undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

Imprivata has provided in this release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States, or GAAP. This information includes Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP net income (loss) per share. These non-GAAP financial measures are not in accordance with, or an alternative for, GAAP and may be different from similar non-GAAP financial measures used by other companies. Imprivata believes that the use of these non-GAAP financial measures provides supplementary information for investors to use in evaluating operating performance and in comparing its financial measures with other companies in Imprivata’s industry, many of which present similar non-GAAP financial measures. Adjusted EBITDA (EBITDA adjusted for foreign currency gains (losses), stock based-compensation, transaction costs associated with business acquisitions and the impact of the fair value revaluation on our contingent liability), non-GAAP net income (loss) and non-GAAP net income (loss) per share exclude amortization expense associated with our purchased intangible assets, stock-based compensation, transaction costs associated with business acquisitions and the impact of the re-measurement to fair value of our contingent liability. Non-GAAP financial measures that Imprivata uses may differ from measures that other companies may use. These non-GAAP financial measures disclosed by Imprivata are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP, and should be viewed in conjunction with, GAAP financial measures. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measure. A reconciliation of GAAP to the non-GAAP financial measures has been provided in the tables included as part of this press release.